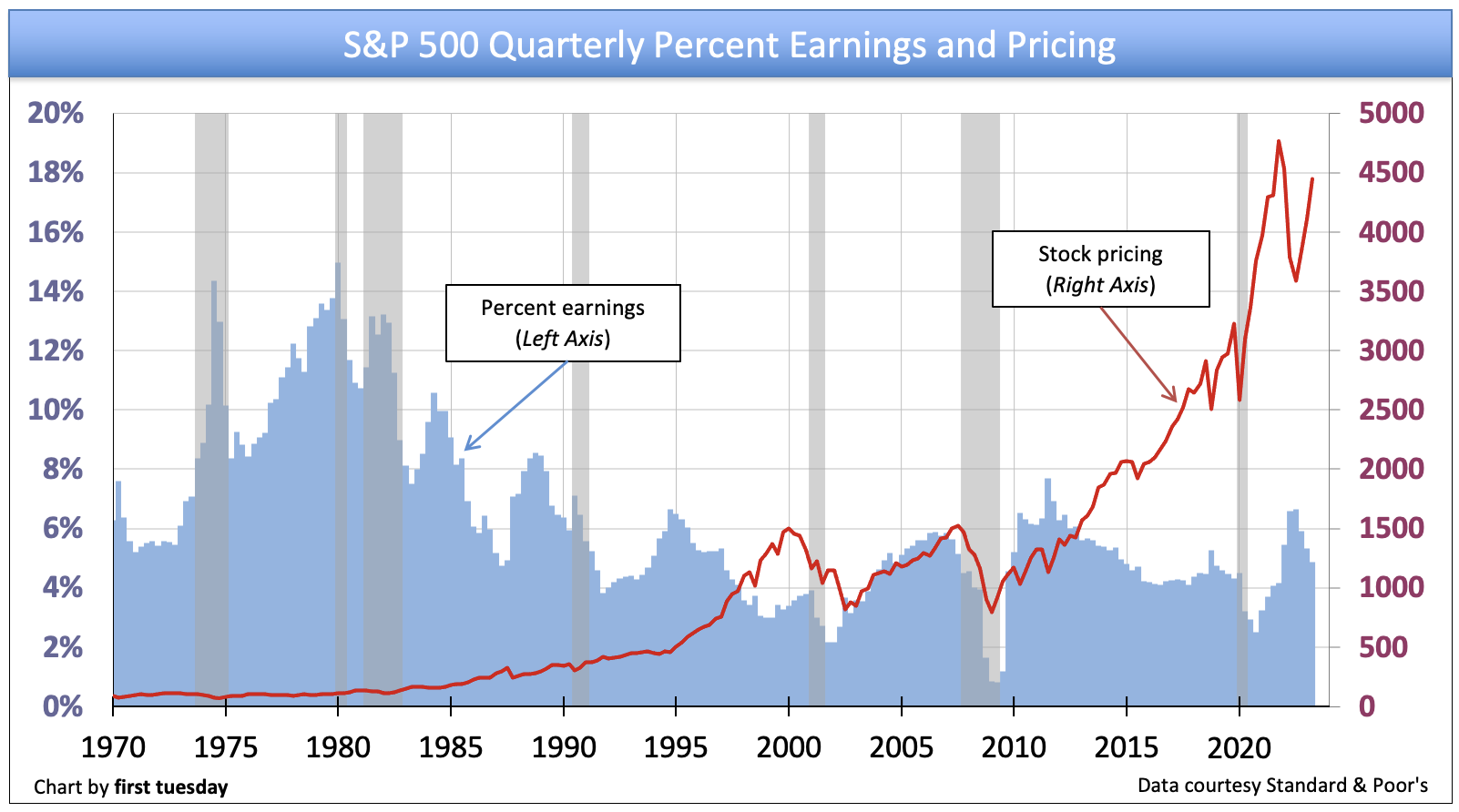

The S&P 500 has been making headlines recently, posting solid gains and closing out November with its best monthly performance of 2024. This surge has been driven by a combination of strong market sentiment, favorable economic indicators, and significant corporate performances. Here’s a detailed look at the latest developments and what they mean for the S&P 500.

Record Gains and Market Performance

The S&P 500 rose 0.6% on Black Friday, marking a strong end to the month. This performance was part of a broader trend that saw the index gain 5.7% in November, driven by robust performances from key sectors and companies. The Dow Jones Industrial Average also posted gains, rising 0.4%, while the Nasdaq added 0.8%1. These gains were achieved during an abbreviated trading day, with markets closing early for the Thanksgiving holiday.

Key Drivers of the Surge

Several factors have contributed to the S&P 500’s impressive performance. One of the primary drivers has been the strong consumer spending during the holiday season. Black Friday, which unofficially kicks off the holiday shopping season, saw significant spending, with forecasts suggesting that shoppers could break spending records in 2024. Retail giants like Macy’s and Best Buy each gained around 2%, while Apple rose 1.1%1. The technology giant is hoping that its recently added artificial intelligence features will entice consumers to purchase new iPhones for the holidays.

Corporate Performances and Sector Gains

The S&P 500’s gains were also bolstered by strong performances from individual companies and sectors. Tesla shares rose 3.7% on Black Friday and posted a monthly increase of more than 38%. The electric vehicle maker is expected to benefit from CEO Elon Musk’s support of President-elect Donald Trump. Additionally, Discover Financial Services led a list of financial stocks that had a strong November, up nearly 23% for the month1. Investors believe that the credit card company’s merger with Capital One has a greater chance of going through under a Trump administration, which is expected to bring less restrictive oversight to the financial services industry.

Economic Indicators and Market Sentiment

Economic indicators have also played a crucial role in the S&P 500’s recent performance. Bond yields fell, with the yield on the 10-year Treasury slipping to 4.19%. This decline in bond yields has made equities more attractive to investors, contributing to the overall bullish sentiment in the market. Additionally, the Fear and Greed Index, which measures market sentiment, is currently leaning towards “Greed,” a signal that often precedes significant market moves.

Global Market Context

The S&P 500’s performance is part of a broader global market trend. While U.S. markets posted gains, global shares mostly fell on Friday after U.S. markets were closed for the Thanksgiving holiday. In Asia, Tokyo’s Nikkei 225 index fell 0.4% after the government reported that inflation in Tokyo was 2.6% in November, up from 1.8% last month2. Chinese markets, however, advanced, with Hong Kong’s Hang Seng index gaining 0.3% and the Shanghai Composite index rising 0.9%. Gains in retailers’ stocks drove market gains after a two-day meeting in Beijing focused on promoting consumption ended on Thursday2.

Future Outlook

Looking ahead, the future for the S&P 500 appears promising. Analysts are optimistic about the index’s potential to continue its upward trajectory, driven by strong corporate performances, favorable economic indicators, and positive market sentiment. However, investors should remain cautious and stay informed about potential risks and market developments.

The S&P 500’s recent performance underscores the resilience and strength of the U.S. stock market. As the holiday season continues and economic indicators remain favorable, the index is well-positioned to achieve further gains. Whether you are a seasoned investor or new to the market, now is an exciting time to be involved in the world of equities.