Microsoft Shareholders to Decide on Bitcoin Investment on December 10

Microsoft shareholders are gearing up for a pivotal decision regarding the company’s potential investment in Bitcoin. Scheduled for December 10, this vote could mark a significant shift in Microsoft’s financial strategy, aligning it with other major corporations that have embraced the digital asset.

The Decision-Making Process

The upcoming vote will determine whether Microsoft will add Bitcoin to its balance sheet. This decision comes amid a broader trend of institutional adoption of cryptocurrencies, fueled by endorsements from influential figures like President-elect Donald Trump and Tesla CEO Elon Musk. Despite the growing interest in Bitcoin, Microsoft’s board members have expressed reservations about the proposal.

Board’s Stance on Bitcoin

Microsoft’s board of directors has not committed to the Bitcoin investment proposal, titled “Assessment of Investing in Bitcoin.” This proposal, submitted by the National Center for Public Policy Research, advocates for Bitcoin as a hedge against inflation. However, the board remains cautious, highlighting the speculative nature of Bitcoin and its lack of intrinsic value. This cautious approach echoes the sentiments of Microsoft co-founder Bill Gates, who has been a vocal critic of the digital asset.

Potential Impact on Bitcoin and Microsoft

A positive vote could enhance Bitcoin’s reputation as a viable asset for traditional corporations, further integrating it into the financial mainstream. Conversely, a rejection could signal Microsoft’s reluctance to follow in the footsteps of companies like MicroStrategy, which holds a substantial Bitcoin reserve. MicroStrategy’s Bitcoin holdings, totaling about 402,000 BTC, are valued at approximately $40 billion, representing a significant portion of the asset’s total supply.

Broader Market Implications

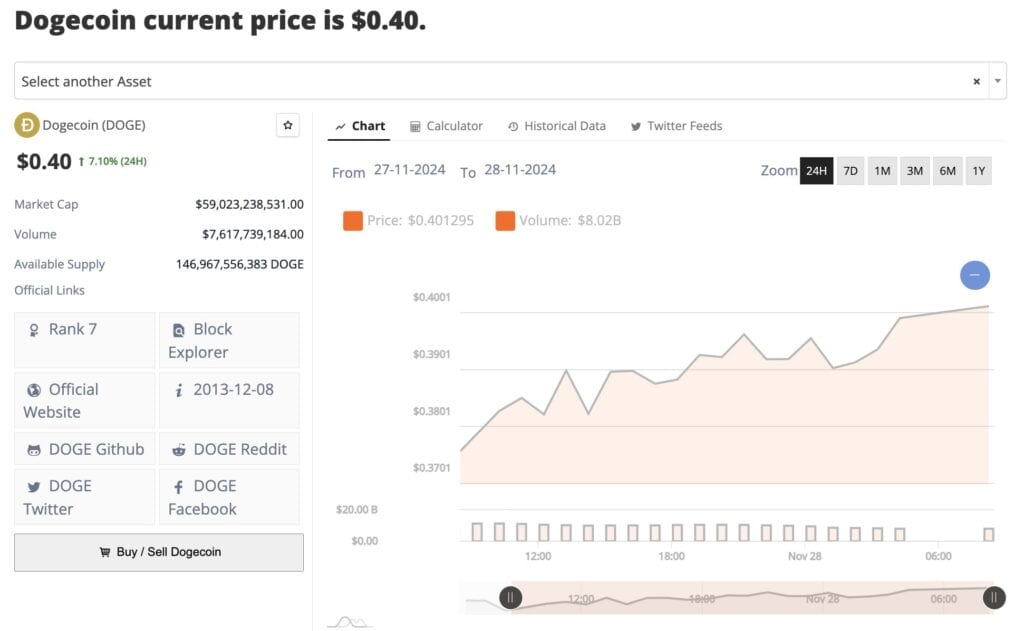

The decision comes at a time when Bitcoin has recently hit the $100,000 mark, validating the confidence of its proponents. Figures like Robert Kiyosaki, author of “Rich Dad Poor Dad,” have long championed Bitcoin, predicting its outperformance compared to traditional assets like gold and silver. On the other hand, critics like Peter Schiff continue to warn about the speculative risks associated with Bitcoin.

Conclusion

The upcoming vote on December 10 will be a crucial moment for both Microsoft and the broader cryptocurrency market. A decision to invest in Bitcoin could position Microsoft as a forward-thinking leader in the tech industry, while a rejection might reflect a more conservative approach to digital assets. As the date approaches, all eyes will be on Microsoft’s shareholders and their final verdict.

Stay tuned for more updates as this story develops and the cryptocurrency market continues to evolve.