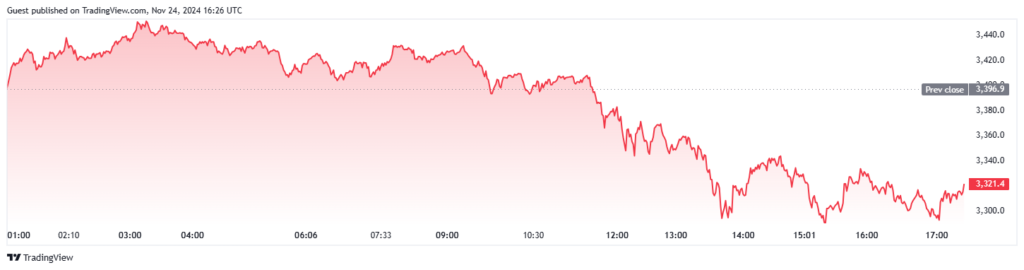

Ethereum (ETH) has experienced a significant price surge, gaining over 7% in the past 24 hours to break above $3,350. This rally comes as Bitcoin (BTC) hovers near its new all-time high of $98,000. Analysts are optimistic about Ethereum’s potential for further gains, predicting an altseason rally driven by capital rotation.

Key Factors Driving Ethereum’s Price Surge

- Bitcoin’s Influence: Ethereum’s recent price gains are closely tied to Bitcoin’s performance. As Bitcoin approaches the $100,000 mark, it has created a positive sentiment across the entire cryptocurrency market, benefiting Ethereum and other altcoins.

- Decentralized Applications (DApps): The Ethereum network has seen a resurgence in activity around decentralized applications, including decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming. These segments have attracted a significant number of active users, contributing to the overall bullish sentiment for Ethereum.

- Technical Indicators: Analysts have observed a potential bull flag pattern forming on Ethereum’s price chart. This pattern often precedes a continuation of an uptrend, suggesting that Ethereum could see further gains in the near term. The Aroon indicator, which identifies trends and their strength, also supports the bullish outlook.

Market Sentiment and Future Outlook

The overall market sentiment for Ethereum remains positive. The recent price surge has been accompanied by an increase in open interest for Ethereum futures, which has jumped 13% to over $20.3 billion. This indicates strong market confidence in future ETH prices.

Analysts predict that if Ethereum can break above the $3,500 resistance level, it could catalyze further gains for bulls. The next major resistance level is around $3,700, and a successful breakout could see Ethereum revisit its previous all-time highs.

Challenges and Considerations

Despite the bullish sentiment, there are some challenges to consider. The ETH/BTC ratio, which measures Ethereum’s price performance against Bitcoin, has fallen to its lowest point since March 2021. This indicates that Ethereum has been underperforming relative to Bitcoin, which could impact its price momentum.

Additionally, the recent outflows from Ethereum spot exchange-traded funds (ETFs) have raised concerns. In the past week, Ethereum ETFs have witnessed a massive outflow of $163 million, representing the third-highest weekly net outflow since these funds became tradeable in July 2024. This trend follows a strong surge in inflows triggered by Donald Trump’s victory in the November 5 US election, which resulted in a parabolic rally in the crypto market2.

Conclusion

Ethereum’s recent price surge to over $3,350 is a testament to the growing interest and confidence in the digital currency market. The positive market sentiment, driven by Bitcoin’s performance and increased activity in decentralized applications, suggests that Ethereum could see further gains in the near term. However, investors should remain cautious of potential challenges, including the ETH/BTC ratio and recent ETF outflows.

As the market continues to evolve, it is important for investors to stay informed and keep an eye on key developments. The growing interest from institutional investors, favorable regulatory conditions, and positive market sentiment all point to a bright future for Ethereum. Whether you are a seasoned investor or new to the market, now is an exciting time to be involved in the world of digital currencies.

Stay tuned for more updates as Ethereum continues its journey towards new milestones!