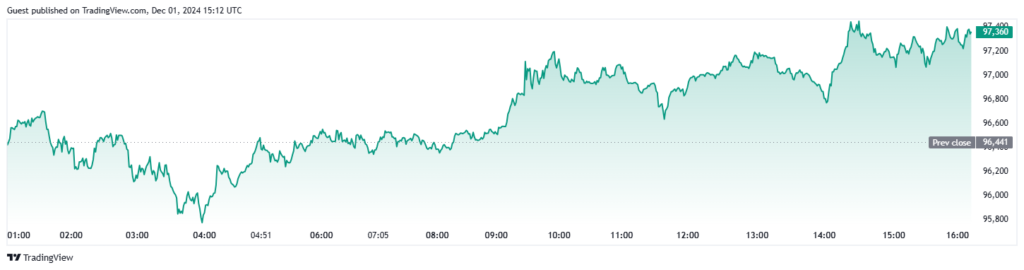

Bitcoin (BTC) has recently experienced a notable price recovery, rebounding 6.25% from its local low of $90,742 to above $96,000. This recovery comes as on-chain data suggests that Bitcoin whales have been taking advantage of the price dip, accumulating a significant amount of BTC.

Whale Activity and Market Dynamics

Data from Cointelegraph Markets Pro and TradingView indicates that Bitcoin whales have played a crucial role in the recent price recovery. Analysis shows that these wealthy investors have been strategically accumulating Bitcoin during the market correction. According to CryptoQuant contributing analyst Caueconomy, Bitcoin whales scooped up approximately 16,000 BTC, worth around $1.5 billion, after nearly $4 billion in BTC was sent to exchanges at a loss by short-term holders.

Institutional and Retail Participation

Despite the substantial accumulation by whales, the analyst noted that this spot buying volume is not yet sufficient to demonstrate a more widespread buy-the-dip pattern. The buying activity remains heavily concentrated among institutional players, with retail trading activity still neutral. For Bitcoin to achieve a new all-time high, a larger spot buying volume from both retail and institutional investors will be necessary.

Technical Analysis and Future Projections

From a technical perspective, Bitcoin has managed an immediate recovery above $95,000, exhibiting a V-pattern from the local low at $90,742. The most logical scenario for BTC is to retest the $100,000 resistance level. However, a daily candle close above the overhead resistance at $96,400 is needed to confirm this upward momentum.

The in/out of the money around price (IOMAP) chart from IntoTheBlock shows that the immediate support for Bitcoin sits within the $92,777 to $95,634 price range, where about 490,570 wallets acquired some 441,250 BTC. This strong support level provides a solid foundation for Bitcoin’s price to continue its upward trajectory.

Conclusion

Bitcoin’s recent price recovery and the strategic accumulation by whales highlight the ongoing interest and confidence in the cryptocurrency market. While the current buying activity is concentrated among institutional players, increased participation from retail investors could drive Bitcoin to new all-time highs. As Bitcoin approaches the $100,000 milestone, market participants will be closely watching for further developments and potential price movements.