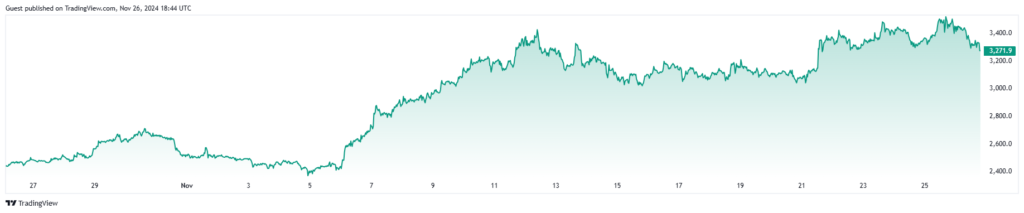

Ethereum (ETH) has experienced a remarkable price increase this November, rising by 34% and reaching a high of $3,500, the first time it has touched this level since July 2024. This upswing follows months of fluctuating prices and a period of Ethereum staking withdrawals that have recently turned into record-breaking inflows.

The surge in ETH’s price is not only tied to broader market movements but also to growing interest in staking, which has seen a major shift. After months of outflows, Ethereum staking experienced a significant inflow, with a record netflow of +10,000 ETH in the past week alone. As Ethereum continues to rise in value, many investors are closely watching these developments to understand the potential long-term effects on ETH’s price and its overall ecosystem.

Ethereum staking has been a key focal point this November, with a sharp rise in deposits. Data from IntoTheBlock revealed that Ethereum’s staking network recorded a remarkable netflow of +10,000 ETH in just one week. A total of 115,000 ETH was deposited, while 105,000 ETH was withdrawn. This substantial inflow marks a significant shift from the previous months, which saw more ETH withdrawn than deposited.

The influx of Ethereum into staking has been attributed to multiple factors. First, the price surge itself has encouraged more users to lock their ETH into the network, seeing it as an opportunity to earn rewards while contributing to the network’s security. Additionally, improvements in Ethereum’s staking infrastructure have made the process more accessible and appealing to a wider range of investors. This surge in staking deposits is not just a temporary trend; it plays a crucial role in reducing the available supply of ETH in the market. With fewer tokens available for trading, this reduction in supply, combined with rising demand, creates a favorable environment for price appreciation.

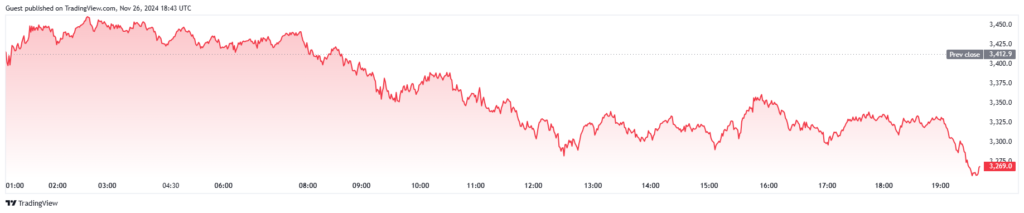

Ethereum’s stock-to-flow ratio, a key measure of scarcity, is also rising, further suggesting that ETH is becoming a scarcer asset, which historically contributes to an increase in value. The recent uptick in staking and the subsequent reduction in circulating supply have already begun to show their impact on ETH’s price1. As of writing, Ethereum is trading at $3,381, reflecting a 7.82% increase over the past week. This positive price action follows the sharp rise from a low of $3,031 to a high of $3,500. The increased demand for ETH, combined with a decrease in available supply, has helped fuel this upward momentum.

The next major price target for ETH is the $3,560 resistance level. If Ethereum can break through this barrier, it could open the door for further price advances, potentially pushing toward new highs1. Ethereum’s recent success isn’t just due to small retail investors. Large holders, often referred to as “whales,” have also played a significant role in Ethereum’s rally. According to IntoTheBlock’s analysis, large investors have been making substantial purchases of ETH, contributing to a surge in inflows. This activity suggests that major investors are positioning themselves for further gains, adding to the buying pressure on ETH. This behavior by large holders signals confidence in Ethereum’s future growth and suggests that more capital is being allocated to the Ethereum ecosystem.