Bitcoin (BTC) has surged past $98,000 for the first time in history, following reports that President-elect Donald Trump’s team is considering establishing a dedicated White House position to oversee cryptocurrency policy.

On November 21, BTC’s price jumped by over 4.50%, reaching a new all-time high of $98,367 (data from Bitstamp). This surge pushed the crypto market capitalization up by 3.65%, hitting the $3.17 trillion milestone.

The “Trump Trade” euphoria could propel Bitcoin to its long-anticipated $100,000 price target by the end of 2024, with crypto betting platform Polymarket reporting that 92% of bets favor the six-figure record high. Meanwhile, predictions for even higher Bitcoin prices in 2025 are gaining traction.

BTC Price Could Hit $200,000 by 2025: Bernstein Research

Analysts at Bernstein, in their October “Black Book,” predicted that Bitcoin could reach $200,000 by the end of 2025. Their bullish outlook is driven by rising institutional demand, positive regulatory shifts, and pro-crypto appointments by Donald Trump.

Another factor contributing to Bitcoin’s potential growth is the proposed establishment of a national Bitcoin reserve. Senator Cynthia Lummis introduced a draft bill advocating for the acquisition of up to 5% of Bitcoin’s total supply over the next five years, representing more than $100 billion in investments.

Additionally, Bernstein points to increasing demand from Bitcoin exchange-traded funds (ETFs) and ambitious purchasing strategies from companies like MicroStrategy, which plans to raise $42 billion for Bitcoin acquisitions over the next three years.

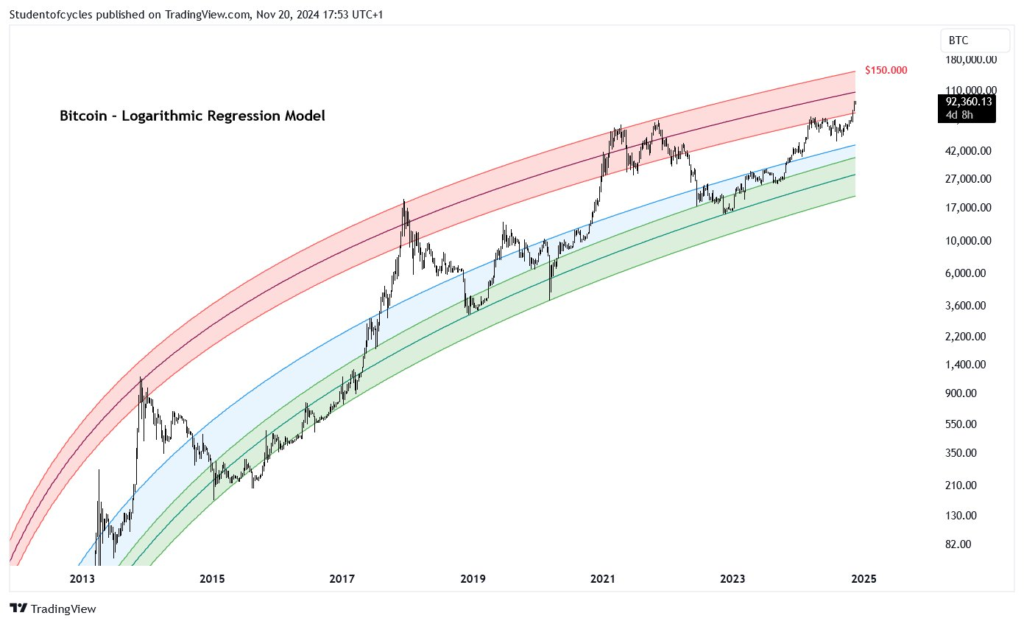

Bitcoin’s Regression Model Predicts $150,000 Peak This Bull Cycle

Bitcoin could peak at around $150,000 in 2025, based on its post-halving performance and historical patterns identified by the Logarithmic Regression Model. Following previous halvings, Bitcoin rallied 8,000% after the 2012 halving, 2,900% after the 2016 halving, and 560% after the 2020 halving. If a similar trajectory plays out, a rally of 300–400% from the April 2024 halving aligns perfectly with the $150,000 upper band of the regression model.

With a pro-crypto administration potentially introducing regulatory clarity and institutions ramping up adoption, Bitcoin appears ready to continue its historical pattern in 2025.

2021 Bitcoin Chart Fractal Hints at Correction After $100K

On a more cautious note, Bitcoin appears to be forming a bearish divergence similar to its price action in 2021, raising concerns that its current rally may peak at $100,000 before a significant correction ensues. In 2021, Bitcoin peaked at $69,000, while its RSI displayed a bearish divergence—higher prices paired with declining RSI. This divergence preceded a sharp 77% drop in Bitcoin’s price, touching its 50-week exponential moving average (EMA) during the decline.

A similar setup could be emerging now, with Bitcoin trading near $97,500 and RSI showing signs of weakening momentum. If history repeats, Bitcoin’s current bull cycle could top out around the psychologically significant $100,000 level, followed by a corrective move. An interim target for such a pullback would be the 50-week EMA at around $60,000, suggesting a potential correction of over 40% in 2025.

Interestingly, the $60,000 level aligns with a key ascending trendline that has acted as support throughout Bitcoin’s recent bull cycle. Historical data suggests that testing this trendline could flush out weak hands, paving the way for strong buyer interest at discounted prices. The subsequent rebound could target the psychologically significant $100,000 level once again by 2025’s end.